The SaaS Metrics For You: Figuring Out The Magic Numbers

Development with out self-discipline is a countdown. Align working reality with capital energy, and also you cease enjoying protection. You construct a corporation that endures.

Some numbers don’t simply transfer traders. Additionally they supply a sturdy backbone to your corporation to assist it maintain and thrive within the subsequent quarter. Nevertheless it’s a bit extra sophisticated for SaaS firms.

Income is gauged over an prolonged interval in the case of SaaS businesses. It’s not speedy.

When you retain your clients for a very long time, effectively and good. That one buyer turns into worthwhile for you for the lengthy haul. However should you go away the prevailing ones dissatisfied, they’ll churn. And the return on the funding you made to amass these clients.

The losses are immense. And the rationale SaaS growth faces a money stream situation.

The sooner they burn to develop the corporate ⇒ The losses enhance. At what second do they hit the brakes or speed up?

That is what SaaS metrics inform them. These inform them a narrative.

However most traders and board members don’t understand this. They concentrate on vainness metrics. Metrics that supply them a shortcut to progress or earnings. This one-dimensionality is a setback. They ring hole.

They could signify one factor on their very own. And one other, given the larger image.

The Rule of 40 (of the 40% rule) is the very best instance.

It’s a vital image of enterprise leaders. Particularly to gauge the group’s present financial state and viability. It’s meant to strike a candy stability between two aspects {that a} SaaS firm barely has at a single time: progress and profitability.

This was particularly to highlight firms that might earn cash (or at the least not lose a bit of it at a time) and develop on the similar time. It isn’t concerning the sturdiness of enterprise. It’s merely a short-term well being check-up.

The Rule of 40 tells you that your engine’s operating effectively. Not that you just’ve obtained flat tires. Or that you just’re about to expire of gasoline.

And truthfully? That’s short-sighted.

This isn’t the metric that your traders will really care about.

And for your corporation’s sustainability? Neither do you have to make investments your sources merely right into a single metric. No fail-safe will work out for you within the blink of an eye fixed.

What Exactly are SaaS Metrics?

HubSpot defines SaaS metrics as:

“SaaS metrics are the important thing efficiency information that software-as-a-service firms monitor to measure progress, retention, and buyer satisfaction over time.”

These mainly let you know (or present you) what’s happening. They don’t merely aid you forecast your corporation’s potential income. However research its well being, progress, and success charge.

SaaS metrics supply a fowl’s-eye view into how advertising and marketing, gross sales, customer success, and product improvement are doing. To win over potential traders. And be answerable to current ones.

Widespread SaaS Metrics that the SaaS Trade Cares About

There are numeric thresholds that plague the market. They matter. However over-reliance on a single mannequin and theoretical proof isn’t sustainable. The mundane SaaS metrics mirror your potential. It doesn’t present you methods to thrive.

Good SaaS metrics don’t imply a lot when income is unsure, and churn is unstable. The polished slide decks show nothing.

They characterize the leaks. However additionally they highlight the leaking spots. You solely want them beneath your management. Weak spot can flip into a possibility when perspective adjustments. It’s not merely about having a technique or metrics in hand, however what you do with them.

It’s the standard of execution that drives the boat. Your SaaS metrics + operational maturity.

Particularly to navigate any fragile spots.

This begs the query: what are these SaaS metrics we’re circling?

Let’s get into them. These are the widespread ones- ones that matter and will matter to you.

1. Buyer churn

Churn isn’t a metric. It’s a verdict.

A quiet execution of the assumption that your product wasn’t value sticking round for. Firms obsess over new pipeline and top-line ARR. However churn is the purest sign of product-market match as a result of it exposes the hole between what you promised and what the shopper really skilled.

It tells the world whether or not your progress is actual or whether or not you’re filling a leaking bucket.

Excessive churn drains money, suffocates momentum, and forces firms to rely upon costly capital. Traders deal with poor retention like radioactivity- not as a result of the quantity is unhealthy, however as a result of it alerts instability.

If clients aren’t increasing, they’re already strolling out the door.

Churn is a mirror. You both face it or die pretending.

i. New buyer churn

Early churn is the purest sign. It exposes onboarding failures, ICP confusion, and hole messaging. If clients churn inside 90 days, it means they by no means noticed worth.

That’s not churn– it’s rejection.

2. Burn a number of

Burn a number of measures to find out how effectively an organization converts money burn into web new ARR. In easy phrases: how a lot fireplace does it take to forge a greenback of progress?

When you’re burning $1M so as to add $1M ARR, that’s a burn a number of of 1.0. When you’re burning $3M for a similar outcome, one thing basic is damaged.

Within the period of low cost cash, burn was invisible- masked by froth and vainness valuations. However now?

Burn a number of is a personality take a look at.

It separates operators from dreamers. Excessive burn means weak self-discipline, unstable unit economics, and a runway managed by traders as a substitute of your individual will. Low burn means leverage. It means you possibly can wait out markets and select capital in your phrases, not another person’s urgency.

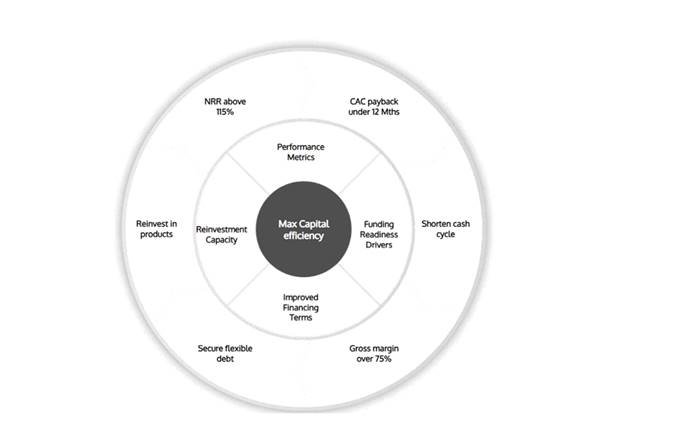

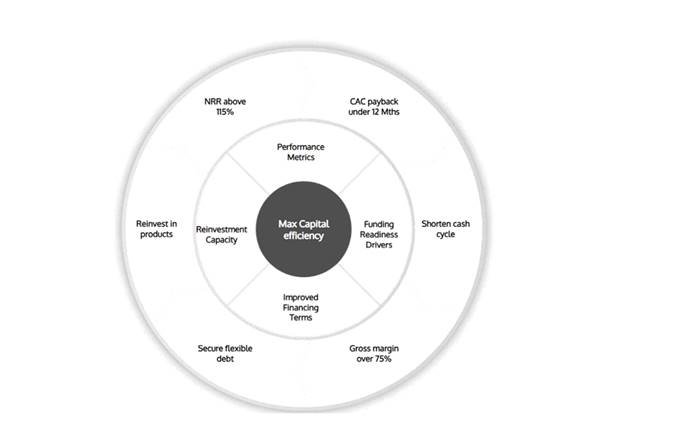

Burn a number of ties straight into the Capital Efficiency Flywheel.

3. Pure charge of progress

Pure progress is the expansion you earn with out synthetic pressure, with out paid advertising and marketing, aggressive outbound, or heavy discounting. It’s enlargement income, product virality, community results, and natural referrals. It’s the gravitational pull of actual worth.

In a wholesome SaaS machine, pure progress is the spine of capital effectivity.

When your base grows, CAC falls, NRR rises, and the flywheel good points momentum with out exterior capital dependency. That’s the way you construct an organization that compounds. When pure progress is weak, you need to spend aggressively to keep up movement.

And that’s when dependence on dangerous, costly capital begins.

Pure progress is the reality serum of product high quality. If it’s a must to shout to be heard, your product isn’t resonating. If clients broaden with out you asking, you’re constructing one thing inevitable.

4. Activation velocity

Activation velocity measures how briskly a brand new person reaches their first second of actual worth. Time-to-value is the battlefield. The longer it takes, the extra curiosity decays, the extra doubt grows, and the sooner churn sharpens its blade.

The pace of activation determines whether or not the person turns into invested or ghosts you. Each further hour in onboarding, each unclear step, each pointless type is a chance for remorse to floor. You aren’t simply combating friction- you’re combating human impatience.

Quicker activation means faster adoption, which drives enlargement, which improves NRR. Higher NRR unlocks higher financing, lowers dilution, extends runway, and strengthens the flywheel.

5. Income churn

Income churn tracks how a lot recurring income you lose from downgrades and cancellations.

If emblem churn is dropping clients, income churn is dropping perception in worth. It exposes whether or not clients are shrinking slightly than increasing, whether or not they’re retreating from dedication. And whether or not utilization is flattening or decaying.

Income churn is the inverse of momentum. Excessive income churn means your corporation is sprinting uphill carrying weights. Each greenback misplaced have to be changed earlier than progress may even start. That’s how firms find yourself in treadmill mode- operating quick, going nowhere.

Fixing income churn calls for understanding not simply why clients go away however why they cut back spending. Generally the enemy isn’t competitors. Generally it’s a scarcity of adoption depth, misaligned pricing, poor utilization segmentation, or shallow worth creation.

Income churn tells you whether or not your product turns into roughly priceless over a interval.

6. Buyer acquisition price (CAC)

Customer acquisition cost is the whole price required to amass a brand new paying buyer. However CAC is misunderstood. It’s not a advertising and marketing metric. It’s a capital allocation sign. CAC tells you whether or not the gas you burn creates propulsion or smoke.

Excessive CAC isn’t all the time unhealthy.

Excessive CAC, succeeded by quick payback and excessive NRR, is highly effective. Low CAC with excessive churn is a lie. The actual query is how effectively your advertising and marketing spend converts into sturdy, increasing income.

It forces you to face uncomfortable questions like:

- Are we promoting to the suitable clients?

- Are we counting on synthetic channels as a result of your product doesn’t attain organically?

- Is your funnel constructed on persuasion over proof?

7. Buyer lifetime worth

Buyer lifetime worth (CLV) represents the whole income a buyer generates over their subscription interval.

However extra importantly, it represents the depth of transformation your product creates. Shallow worth means brief life. Deep worth means compounding income.

In an efficiency-first world, CLV is a weapon. It dictates how aggressively you possibly can put money into acquisition, how resilient your income base is, and whether or not exterior capital turns into an amplifier or a crutch.

CLV is the place reality hides.

Excessive CLV alerts power and maturity. Low CLV alerts fragility and dependence. Traders know the distinction. That’s why CLV drives valuation greater than progress charge.

The flywheel lives or dies on the longevity of income. If clients don’t keep lengthy sufficient or broaden deeply sufficient, the wheel by no means turns.

8. CLV-to-CAC ratio

The CLV-to-CAC ratio solutions one query for you: Is that this account value it?

What number of {dollars} do you get again over time for each greenback you spend to amass a buyer? A ratio beneath 3:1 means your mannequin bleeds effectivity and calls for capital to remain alive. A ratio above 5:1 is a sign of management and leverage.

However the entice is celebrating this quantity with out understanding its composition. You may inflate CLV by way of optimistic assumptions. You may deflate CAC by way of selective accounting. Self-importance ratios don’t idiot lenders. They learn money conduct, not PowerPoint slides.

The actual which means of CLV/CAC is alignment.

The tighter your acquisition engine and retention engine join, the sooner capital compounds.

9. Internet promoter rating (NPS)

NPS measures a buyer’s willingness to suggest your providing. However beneath the quantity lies one thing uncooked: emotional conviction. NPS isn’t about satisfaction- it’s about advocacy.

Excessive NPS signifies your product has develop into a part of the person’s identification. Low NPS means indifference. And indifference is demise disguised as silence. Clients hardly ever churn loudly. They churn emotionally lengthy earlier than financially. NPS is commonly the primary sign.

The hazard is treating NPS like a survey metric slightly than a battlefield report. When you ask clients for suggestions however ignore their scars, NPS turns into theater. Actual operators hunt the anger, not the compliments.

Traders worth NPS as a result of it predicts enlargement and natural progress. Excessive NPS means pure progress. Pure progress means decrease CAC. Decrease CAC means negotiating energy. Energy means higher capital phrases.

NPS is about loyalty. Loyalty is earned in blood by way of relentless worth, precise outcomes, and remodeled identification.

10. Buyer engagement rating

Engagement is the heartbeat of a product’s soul. It reveals whether or not clients live inside your product or merely visiting. Excessive engagement means your product is woven into day by day workflow. Low engagement means churn is already loading its bullet.

Engagement issues as a result of it predicts everything- renewals, enlargement, upsell, advocacy, onboarding effectiveness, product relevancy. It’s a main indicator. Income metrics path it.

Monitoring logins isn’t engagement. Monitoring characteristic utilization isn’t sufficient. Engagement is about depth, frequency, breadth, and behavioral dependency:

Would their world break in case your product disappeared tomorrow?

If the reply isn’t any, the connection is short-term.

Engagement rating forces honesty. It reveals whether or not worth lives in your advertising and marketing or contained in the product expertise.

11. Certified advertising and marketing visitors

Site visitors means nothing. Certified visitors showcases intent. Anybody can purchase clicks. Few can appeal to dedication. Certified visitors alerts that your message is reaching the suitable minds on the proper second with the suitable drawback.

The world is drowning in quantity. Technique is precision. The businesses profitable at present aren’t shouting louder- they’re talking to fewer folks extra clearly.

Certified visitors determines CAC effectivity. A funnel fed by noise inflates spending, slows gross sales velocity, and forces firms to boost capital out of weak spot.

12. Lead-to-customer charge

This metric reveals the effectivity of your conversion engine.

What number of leads really develop into paying clients? It exposes whether or not your demand engine is aligned along with your ICP, whether or not your gross sales course of is sharp, and whether or not the hole between need and buy is frictionless or deadly.

A powerful conversion charge lowers CAC and compresses payback. A weak one inflates burn, forces determined pipeline progress, and drives dependency on capital.

Conversion charge is a narrative of coherence:

- Does your product ship the worth your messaging guarantees?

- Does your gross sales movement match buyer readiness?

- Are objections actual or manufactured by confusion?

13. Leads by lifecycle stage

This metric breaks leads into phases: consciousness, engaged, certified, sales-ready, dedicated, buyer. It forces you to grasp not simply quantity however development. Motion by way of phases reveals whether or not the system is alive or caught.

If leads stagnate in a single stage, one thing is broken- messaging, focusing on, timing, pricing, or onboarding expectation. Firms that ignore lifecycle progress construct large top-of-funnel machines that convert nothing.

Lifecycle leads reveal momentum. Momentum is every thing. Traders don’t fund goals however velocity. Lenders don’t belief aspiration. They belief predictability. Lifecycle motion proves each.

This metric ties on to the flywheel as a result of it exposes conversion well being throughout time. Fixing friction at any stage strengthens CAC effectivity, speeds CAC payback, and improves money stream velocity.

Why Having the Right SaaS Metrics in Your Pocket Issues

This 40% rule doesn’t get nuance.

You may as well make investments chunks right into a large-scale one-time advert marketing campaign. However should you carry on dropping 20% of your clients annually, your corporation mannequin is unstable. Though the expansion charge is 50%.

It’s a standalone metric good for serving to management resolve the place to speculate. Your potential traders must know the chance ranges earlier than funding you. Or gauge your organization’s a number of. As a result of the funding you obtain severely is dependent upon your SaaS enterprise’s functionality to get well from the price of buying clients.

CAC payback is a big deal. However that’s not all you possibly can depend on.

Numbers could be manipulated. Companies can simply select one or the opposite so long as the whole stays 40% and even exceeds it. This is the reason most leap to getting in new gross sales over specializing in retention numbers. No matter floats their boat.

However with a leaky bucket- excessive buyer acquisition however larger buyer churn, the boat doesn’t row too far. And there are metrics that traders nonetheless understand as dangerous. You may have good payback however have excessive buyer focus and burn a number of.

It’s straightforward to develop into determined at this hour and attempt to show your value to potential traders. Solely to simply accept funding on unhealthy phrases. That turns into your Horcrux.

There are an entire lot of downsides to accepting investments which can be in unhealthy religion. Excessive price of capital. Early dilution. Operational restrictions. Strict covenants. Lack of possession.

That’s why SaaS firms want a analysis. Not a well being check-up.

However that calls for understanding what to verify for. On this case? Sturdy metrics. Ones that join financing with unit economics. That’s what SaaS calls for.

Crux of Selecting the Proper SaaS Metrics: Align Operational Efficiency and Financing

One other mistake that the majority SaaS firms make is sticking to unit economics. They dwell and die by it. This implies how every buyer (a unit) impacts the long-term monetary efficiency. They typically leverage the “unit-as-a-customer” mannequin.

Once more, it’s essential to gauge the viability of your corporation mannequin. It tells you ways effectively you flip investments into progress and earnings.

The quantity can look nice on the skin, however your SaaS firm can nonetheless fail. Particularly once you don’t obtain capital on good phrases, otherwise you burn a number of surges. You burn money sooner than you resuscitate it in income.

Nonetheless, if not tied to a capital technique, it’s grossly inadequate.

That’s why it isn’t all that your potential traders care about. CAC payback would possibly run the present. Nevertheless it must be taken in context with different SaaS metrics akin to buyer churn and Internet Income Fee (NRR).

SaaS enterprise fashions are complicated. And so they rely upon distinctive metrics akin to ARR, MRR, NRR, subscription gross margins, in contrast to different industrial domains. Every metric should correspond with the others. They’ll’t exist in a vacuum.

You want a singular stack of SaaS metrics that truly matters- to each you and your potential traders.

- Quicker CAC payback

- Sturdy buyer retention

- Secure margins

The reality is that nice metrics don’t assure survival. Alignment does.

When operational efficiency and capital technique reinforce one another and don’t conflict, the flywheel turns. That’s the place energy is constructed.

As a result of in the long run, SaaS doesn’t fail from gradual progress. However from specializing in nitty-gritty that maintain no sustainable worth.

Source link

latest video

latest pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua