Fintech: Managing The Fashionable Undercurrents Of Wealth Administration

Monetary recommendation is primarily restricted to cellphone calls and emails. However with fintech making splashes, will wealth administration companies come out of their bubble?

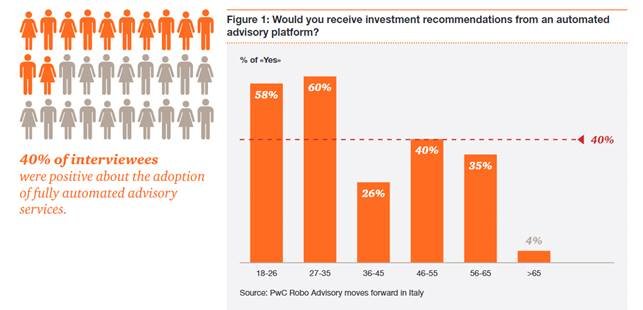

Exactly in 2017, PwC printed a four-part report on the impression of fintech. One in every of them outlined the launch of “robo-advisors” funding platforms throughout Italy. It was elementary to assessing whether or not the monetary world was prepared for automated advisory options.

And the evaluation graph appeared one thing like this:

Supply: [PwC]

Over 40% of the interviewees positively really feel that the way forward for funding recommendation will likely be automated. That was the essential conclusion drawn over eight years in the past.

And eight years later, monetary establishments equivalent to BlackRock and Charles Swab are amongst the primary ones to include robo-advisors into their portfolios.

However the survey additionally highlighted a hitch- one-size-fits-all advisory fashions wouldn’t cater to totally different buyer profiles. And three totally different ones needs to be considered- conventional, multi-tasking, and clever. So, the underlying logic drifted strongly in the direction of conventional advisory fashions. With a number of most well-liked banks choosing gradual digitization and automation to revamp this mannequin.

Nevertheless, eight years later, the demographics of the buyers have modified. The identical conclusion is deemed inconclusive immediately.

However we are able to’t blame the survey; it’s merely a comparability.

Wealth Administration and Advisory Fashions: Focusing on the Crux of the Downside

Automated recommendation, in the long run, didn’t maintain a definitive face. And with funding efficiency and advisory companies working in tandem, the expectations had been at all times increased. Face-to-face carried extra weight, and contemplating the dangers, why shouldn’t it?

Fintech’s motion into wealth administration was merely a whispered suggestion when this PwC report was printed.

Nevertheless, investor expectations immediately are with a generational hole. And on the middle stage for the wealth administration companies’ new shoppers are millennial buyers. It’s a conundrum- the worldwide wealth is shifting throughout generational demographics. Whereas conventional wealth administration companies want to keep on with previous methodologies, with a number of upgrades right here and there, this creates a spot.

This doesn’t pair nicely with millennial buyers’ necessities: sooner, cheaper, and higher service, with clear charges and extremely personalised recommendation. The impression of fintech on the wealth administration business is exactly about 5 customer-centric sides:

- pace

- high quality

- accessibility

- efficacy

- comfort

However they’re skeptical whether or not conventional advisory fashions can meet these calls for. In any case, this technology is extra tech-savvy, particularly after they witnessed what is without doubt one of the worst monetary crises in 2008.

This has left wealth administration companies below duress- they’ll have to satisfy millennial buyers’ wants in the event that they don’t want to lose their market share. They usually need to retain the folks aspect, whereas leveraging tech to reinforce present abilities and companies.

With the companies realizing this shift, they’re poised to enter a brand new period of worth creation. Led by the front-running driver of this much-needed transformation: Fintech. Actually, it’s nothing new.

You may hint fintech’s introduction again to the mid-Twentieth century- to the ATMs and bank cards. Nevertheless, it really gained ample momentum when customers started relying much less on bodily banks. A brand new period was born- one among cellular banking apps and digital wallets.

Therefore, the way in which we view, leverage, and work together with cash has advanced to some extent. The wealth administration business has now realized that fintech is a complement, not an alternative to conventional advisors.

Right here, the weblog navigates what fintech’s impression is definitely about and why it holds a vital area in wealth administration.

What’s Wealth Administration?

The instruments, actions, and techniques used to enhance somebody’s monetary state or place are known as wealth management. It combines funding and portfolio administration with monetary life planning to realize particular objectives over a interval.

There was an important data hole beforehand. Individuals assumed that solely high-net-worth households, business leaders, and people might afford this monetary service.

However the creation of fintech has proved them incorrect. It’s for everybody with a particular monetary aim. That’s why we’ve got JPMorgan, Goldman Sachs, and Morgan Stanley immediately.

Wealth administration is mainly consulting. As a result of monetary markets are unpredictable, shoppers want to handle their portfolio to keep away from as a lot market turbulence as doable. These companies assist shoppers plan out their retirements, accounting and tax, and authorized and actual property planning. And curate a customized fund-allocation technique below a portfolio.

Not all investments yield anticipated returns. There’s substantial threat in managing portfolios if you don’t have monetary in addition to market data. However there’s immense progress potential.

That’s the crux that shoppers and buyers want to goal. And that’s exactly the place fintech in wealth administration turns into crucial. Particularly in overcoming important challenges that halt shoppers from gauging the absolute best recommendation relating to their portfolios. And for companies to enhance their worth choices.

Challenges equivalent to these:

- information safety and privateness (high-value problem)

- modular protection throughout each human and digital touchpoints

- Clients should have higher data of investments

- extent of reliability on tech platforms

- pricing of wealth choices

Fintech in Wealth Administration: An Innovation or a Disruption?

Wealth administration isn’t simply cash change. And neither is it a easy transaction.

It requires a portfolio-specific, personalised technique to yield precise returns. And on condition that there are financial processes concerned, this perform comes with higher consumer expectations:

- Transparency into price pricing.

- Constant guidelines and frameworks.

- Stricter government-instilled wealth administration laws.

These inefficiencies simply drive folks out of this enterprise or restrict their progress. It has nudged monetary establishments to query the adequacy of present frameworks and the resilience of conventional banking techniques.

Wealth administration companies should enhance their buyer experiences. Or they find yourself in a ditch- shedding mindshare. That’s exactly what 80% of buyers and shoppers additionally desire.

As a result of the investor base immediately needs to zero in on funding alternatives that transcend conventional belongings. However only a few really maintain any monetary literacy.

How do wealth advisors match the anticipated ranges {of professional} management- from monetary planning for the center class to classy recommendation for the high-net-worth people?

Proactive digital adoption.

For cost-effectiveness. Transparency and management. Customized funding methods. Enhanced price-to-value. That’s how shoppers select the firms- they gravitate in the direction of ones that provide them the safety, belief, and security web.

The Innovation

Amidst all of the fintech improvements rampant out there, there are some making big waves-

Blockchain, AI/ML, and large information analytics. It’s the multi-faceted impression of fintech on wealth administration.

And observably, that’s what’s crucial immediately.

Buyers need personalised and accessible wealth administration companies. They’ve the urge for food, simply not the entry to it. It’s as a result of these shoppers, particularly throughout Africa, Asia, and Latin America, have by no means had entry to such refined avenues.

Fintech is clearing away these hurdles. It’s eradicating the wealth managers’ dilemma- connecting them to beforehand untapped capital swimming pools.

Consider a mid-sized wealth administration agency in Singapore. Its shoppers are, to a fault, bold and resourceful. And fairly desirous to diversify past native equities and bonds. They want to take a leap of religion in the direction of the enterprise capital alternatives in Europe and progress fairness funds throughout Silicon Valley.

They usually inquire about their wealth supervisor about this. The reply is at all times the identical echo: an absence of entry. Small funds lack monitor data. The paperwork is at all times too advanced. Or fund allocation is simply open for elite gamers (HNWIs).

This has halted wealth engagement, distribution, and possession. And concentrated it inside a number of high-net-worth communities. Creating an inequality in credit score and asset possession.

It’s by no means been about shortage. It’s about accessibility- Entry parity.

The millennial buyers of immediately, irrespective of sophistication, look to diversify their portfolios into alternate options and search security from market volatility.

Fintech throughout wealth administration is granting them that gateway. It’s turning into a norm- the infrastructure of a revolution in monetary advisory. Fintech is the lacking puzzle to that entry.

Fintech is the concrete filling the issue of economic inclusion. And the structural gaps are addressed by abolishing the necessity for conventional intermediaries and growing a low threshold for entry.

It’s an keen step in the direction of wealth democratization via robo-advisors, cellular fee techniques, peer-to-peer lending, and general decentralization of finance.

There’s intense strain on wealth advisors. From private conferences to demand for decrease charges and personalised recommendation, the dynamic consumer buyers’ wants are creating an surroundings for companies to undertake new tech. With fintech, companies want to unlock billions in untapped market demand.

- Blockchain: The decentralized, tamper-resistant consumer ledger that may solely be accessed by authorized techniques. One can merely retailer and share a golden copy of the shoppers’ information to retain integrity. You don’t should retailer a number of consumer data. It additionally fosters real-time portfolio rebalancing with out human intervention. Consider when a consumer’s portfolio deviates from its goal because of unpredictable market actions. Blockchain streamlines this.

- Cognitive computing, ML, and AI: This helps extract worthwhile insights from huge information. And facilitate high-level accuracy and algorithms by diving into heaps of consumer information and optimizing for increased returns on funding. AI helps predict which belongings may probably be in danger. Moreover, cognitive capabilities assist reply advanced consumer queries in real-time and instill deep personalization, curating funding methods.

- Robo-advisors: A shift from an advice-based mannequin to an algorithm-based consultancy mannequin. They’re automated funding recommendation suppliers that assist with monetary planning based mostly on shoppers’ threat urge for food and price minimization. Robo-advisors are mainly poster youngsters for low-barrier entry, clear, and low-cost advisory companies.

- Embedded automation: Wealth administration platforms and apps are being embedded into non-finance platforms, equivalent to Shopify or Uber. Particularly to streamline consumer entry.

The incorporation of those tech and extra into wealth administration is the constructing block for a hybrid recommendation mannequin.

What exactly does that appear like?

Hybridity of Your Tech-Powered Wealth Administration Providers

Shoppers select advisors for communication. And for emotional resonance. That’s what drives connections in wealth administration.

Customized and related communication elevates confidence in advisors by 77%. And that’s a whopping lot. In the meantime, an absence of responsiveness is cited because the second elementary purpose for dropping a wealth administration advisor.

And infrequently, administrative duties take away essential time that could possibly be spent participating with shoppers. That’s the door fintech has opened.

Fintech’s adoption in wealth administration has helped automate menial and mundane duties. Particularly for advisors to do what they do best- talk with their shoppers with belief and persistence. From chasing paperwork to comprehensively understanding their monetary state of affairs and providing a formidable advice.

That is what precise wealth administration recommendation is. The client-advisor relationship is the nucleus of wealth administration.

And the place buyers aren’t pleased with digital options or the issues of a robo-advisor, human interplay is what’ll assist row their boat. Face-to-face interplay typically communicates extra worth than one may even assume in a broad business with numerous segments and distinct necessities.

Wealth administration immediately doesn’t boil right down to the technicalities. It’s about versatile and tailor-made options that cater to all demographics. As a result of there’s a deep inclination in the direction of digital interactions, and that’s true. However shoppers nonetheless admire personal, face-to-face communication–

“There’s a want for digital wealth platforms to be each absolutely digital and absolutely human, as shoppers can swap seamlessly between the digital and human expertise. This affords a hyperpersonalized expertise that caters to the wants of various shoppers at totally different instances.”

Fintech within the wealth administration business is not a differentiator because it was a decade in the past.

From being a nice-to-have, tech in wealth administration has turn into a must have. Right now’s buyers, each Gen Z and millennials, are skeptical, cost-conscious, and research-oriented. Their normal belief in banks and non-bank monetary establishments isn’t on the ranges it needs to be.

“The new generation of investors needs options based mostly on their life objectives and events- older millennials beginning households need to understand how they’ll save up for a home, and Gen Z are trying on the mounting nationwide scholar mortgage debt, need to perceive how they’ll pay for school.”

It’s why the wealth administration advisory mannequin is crucially constructed on communication. As a result of your millennial buyers are hesitant, why we mentioned the necessity for a hybrid advisory mannequin.

As a result of fintech in wealth administration will not be merely about technological breakthroughs. And the way these rising applied sciences combine into present conventional fashions. It trickles right down to discovering why fintech is a necessity in wealth administration within the very first place-

The consumer demographics and the segments that truly choose on your monetary recommendation have inherently modified.

It’s a transforming of wealth management- one the place digital tech frees advisors from time-consuming, computationally heavy duties. And refocuses their precedence in the direction of relationship constructing to instill belief.

Source link

latest video

latest pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua