Social Media Advertising and marketing For Monetary Providers

Gen Zs and millennials don’t resonate with jargon-heavy, technical messages of conventional banks. Can social media advertising and marketing for fintech open a brand new pathway?

Social media is among the most sought-after advertising and marketing channels after e-mail at the moment. It’s curated and interactive.

Isn’t that solely a single a part of the image?

There are bits not as vibrant as Instagram or as brazenly opinionated as X.

And that’s the place we should look. The remaining 50-40%. That’s what companies leverage it for. They need perspective and nuance that they don’t discover on different channels, even their very own web sites.

Social media has undoubtedly turn into an avenue to dissect a few of the most urgent issues.

That’s why these platforms have turn into the molecules of selling. It’s true for the general market. Nevertheless, monetary establishments are nonetheless catching up.

The benefit of social media advertising and marketing for monetary companies is apparent.

It’s a communication device. A buyer listening medium. Opinion gatherer. Particularly for monetary merchandise which are advanced and too intricate to crack open.

The merchandise aren’t as fascinating as a designer bag or a automobile. However they’re in depth. And that’s why most monetary establishments assume product-centricity of their advertising and marketing techniques.

That’s limiting their attain. And market progress. And their publicity.

So, monetary establishments should pivot- higher perceive clients. And reiterate what advertising and marketing is to them.

Why is Social Media Advertising and marketing for Fintech Important?

The whole thing of selling has been oversimplified right into a single perform. The nuance? Gone. Erased. And changed by tech. Though that wasn’t the first intention. It was unintentional, however it drives the boat.

It’s as a result of companies and entrepreneurs haven’t understood the place to undertake tech. Particularly, past the mechanical necessities of selling operations. Their eyes are solely set on viewers engagement and belief constructing.

That is true for nearly each business. However what if we topple the angle?

These are KPIs for your enterprise. Not in your consumers. For these buying your options.

Generally, the customer’s perspective continues to be lacking. Buyer information is restricted or uncared for. Product-centricity may elevate your gross sales. However it gained’t provide perspective on what’s working and what isn’t. You’re dropping on long-term sustainability this fashion.

However those that do (your rivals) will zoom previous you.

How can monetary establishments navigate this?

Let’s begin with the fundamentals.

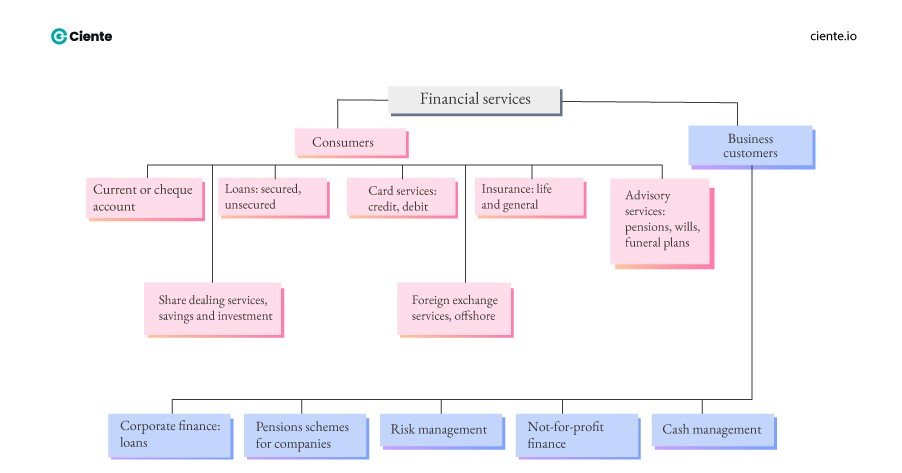

Monetary establishments maintain their clients’ present accounts. So, principally, they need to be in a greater place to know what they want. It’s not only a clear-cut understanding. It’s in regards to the multi-facetedness.

The opinions and experiences of those that leverage these monetary companies. For FIs to have the ability to orchestrate interplay methods and options that cater particularly to completely different viewers segments. And to the purchasers of the longer term.

That’s the essential distinction in finance. It’s not only for the ‘now’ however the faraway future, too. And the options and messaging should replicate it.

A Case for Social Media Advertising and marketing in Fintech: Money App Fridays

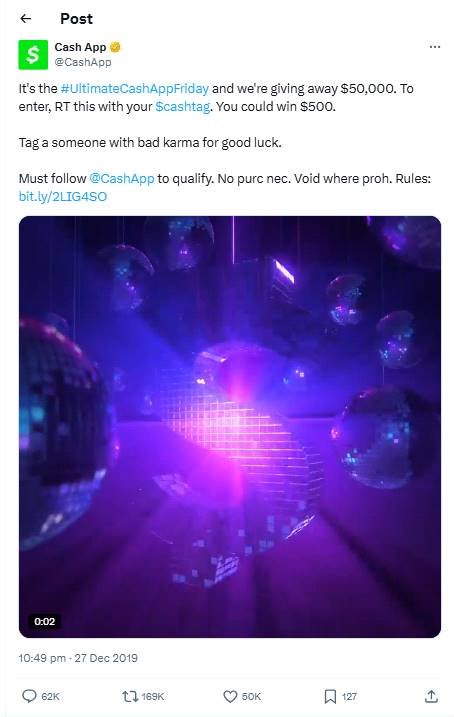

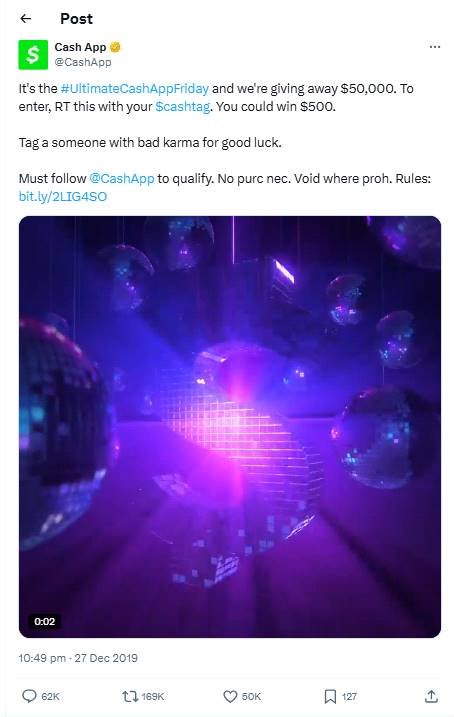

Consider CashApp’s 2020 viral “Cash App Fridays” second.

Keep in mind how viral it acquired on social media. And the way its energetic customers skyrocketed to 24 million, within the US alone.

Cellular funds are perceived as burdensome. As a result of who likes cash getting debited from their accounts? However CashApp flipped the world of cell funds on its head.

Turning it right into a viral social media sensation. It didn’t merely have customers speaking about money- they even began sharing it. The model inspired its viewers to retweet CashApp’s tweet with their $Cashtag usernames to win thrilling money prizes. It acquired the viewers dashing to take part.

It wasn’t a easy giveaway. It was a viral second that introduced substantial consciousness to Money App. A model that needed to proclaim that fintech doesn’t have to be boring. The impression?

50k+ retweets, likes, and feedback. And its annual internet income grew to $1.11 billion- nearly 157% year-on-year.

Fintech may be enjoyable, and it was. However what Money App did was not merely provide monetary incentives and reductions to its customers. It churned customers into its model story.

That was social media advertising and marketing in fintech executed completely proper.

You possibly can’t consider monetary companies as remoted from those that leverage them. The merchandise may be difficult to penetrate. However 1000’s and hundreds of thousands of individuals leverage them- people and companies.

The Takeaway?

You possibly can’t take away your viewers out of your story. Particularly, to centre solely your product.

What a fintech social media marketing campaign required- Money App’s marketing campaign had it. It amalgamated enjoyable and monetary worth. It created a buzz whereas attracting natural sharing and significant engagement.

And turned mundane transactions right into a social sharing occasion.

This has reworked fintech advertising and marketing eternally. Particularly how fintech firms work together with their audiences and encourage them to work together with their platforms in return. One thing in return for nothing. This single advertising and marketing gimmick put Money App on the map.

Merely as a result of it invited its viewers to be part of a neighborhood. That’s why it’s nonetheless fashionable and reaping fruits for Money App and its customers even at the moment.

Social media advertising and marketing spotlights the enterprise’s potential because it did in Money App’s case.

Social Media Advertising and marketing for Fintech: The Hidden Psychology

Regular customers noticed a chance, however Money App noticed limitless buyer information and habits that they may examine. What delights clients and what leaves them satisfied- a real-time marketing campaign suggestions.

However maintain your horses. There’s one other important cause why fintech should leverage social media.

First, it decodes your enterprise in your end-user. Not by means of your difficult merchandise and messaging, however in a extra stripped-down apparel. Right here, advertising and marketing’s potential shines by means of.

Second, you obtain entry to distinct demographics, particularly the youthful generations making up at the moment’s investor base.

And lastly, it may possibly enable you to navigate a big ache level for each fintech firms and their clients: safety.

Customers are cautious with regards to something that features a financial debit or credit score. As a result of with the digitization of banking, there’s been a surge in malicious actors. Particularly cyber assaults and information threats. Clients aren’t able to partake in any trade except there’s sufficient proof (proof and credibility) of the opposite get together.

However Money App’s social media tactic was a trust-building motion. Clients seamlessly participated within the marketing campaign. Particularly as a result of it didn’t merely embrace financial trade. It promised worth and entertainment- two aspects on reverse spectrums within the finance business.

And thru this marketing campaign, customers who have been hesitating to make use of the app earlier than discovered confidence and security in leveraging it.

Isn’t that advertising and marketing’s objective? To make clients really feel assured within the determination they’re making. Give them readability, confidence, and comfort. That’s exactly what Money App did.

However it solely works if you’ve a social media advertising and marketing technique in place.

The Tiny Dos and Don’ts for Your Fintech’s Social Media Advertising and marketing

These viral moments don’t occur on a whim. They’re deliberate, curated, and executed. And as a fintech firm, do you wish to be on socials as a result of that’s the pattern proper now?

Chasing coattails is not going to get you anyplace. We’ve established that product differentiation for monetary companies is at an all-time low.

So, assume. Suppose: why would you like your fintech model to be on social media?

Is it publicity, customer support, or engagement?

You’ve a disruptive monetary answer. So, shouldn’t your social media showcase that?

Deal with your social channel in another way.

The factor is, social media is for unbiased communication to shine by means of even probably the most inflexible limitations. It makes it simpler for manufacturers to penetrate completely different viewers segments. However will you actually get any outcomes in the event you’re speaking about your options and the wonderful gives?

It’s a downright no.

The place’s the worth for the platform and people who are most definitely to comply with you?

Your web page ought to replicate that. Don’t do social media for clout. Do it to supply worth to your clients and construct your brand- a picture other than the platform for financial trade.

As monetary companies turn into digital-first, social media will maintain the ability to both mislead or empower its clients.

Buyer inertia in monetary companies is sluggish. Monetary customers take years to vary their service suppliers. It’s a identified reality, particularly throughout rising markets.

Clients are usually drawn in the direction of established and enduring monetary establishments. Ones seen because the bullwarks of stability throughout market volatility. However this purview is altering.

Fintech is having its second. It has reworked how clients save, trade, retailer, and spend cash.

However individuals proceed to be scared. Finance administration isn’t any joke.

Nevertheless, fintech manufacturers are hoping social media advertising and marketing can change that. They wish to appear because the promising options to banks, however not determined. They wish to instill belief in clients. And long-term sustainability by means of financial and credit score cycles.

Be enduring manufacturers.

That’s what social media advertising and marketing for fintech should do- be this channel of communication and provide new worth to its clients.

All of the whereas appearing because the bridge of belief.

Source link

latest video

latest pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua