Is SoftBank Doubling Down On OpenAI? Sells $5.8bn NVIDIA Stakes

Softbank’s sudden exit from NVIDIA isn’t the monetary large cleansing its arms of AI. It’s merely revamping its funding methods.

There was rampant hypothesis (and sure-shot statements) concerning the AI bubble. However just a few out there have actually gauged if AI is actually making a bubble, or it’s merely a precaution, a method of being cautious after the dot-com bubble.

Every totally different quarter this 12 months has flagged down a warning that this potential bubble might burst. And ship all of us toppling- the G7 haven’t any long-term, sustainable AI mannequin in sight. However they proceed to take a position billions of {dollars} into synthetic intelligence.

Listening to of Softbank promoting its stakes in NVIDIA for $5.8bn despatched shivers down the market.

Nevertheless it isn’t giving up on AI simply but. The monetary establishment is merely doubling down on OpenAI, which it believes holds extra promise. Particularly after it reported $15.99 billion in valuation features pushed by its OpenAI holdings.

Why?

For Softbank, its funding in OpenAI is extra substantial. It’s additionally releasing up extra property to additional spend money on new avenues. And diversify its portfolio after they made a $30bn funding in OpenAI.

In accordance to some market analysts, it’s not as if Softbank is abandoning the AI route. It’s nonetheless the shiny, shiny plaything. Solely that the finance large might have discovered newer toys, which it believes maintain extra potential than NVIDIA.

“Buyers usually promote out of positions after they imagine the valuation is just too wealthy, the expansion prospects for the corporate are much less engaging than earlier than, or they’ve discovered one thing higher to again and wish money to make that funding,” chimed in AJ Bell’s investment director.

And additional on, tried to justify this sudden shift–

“Nvidia’s function in an AI world is already well-known, but OpenAI’s place continues to be evolving, so it’d merely be that SoftBank sees the latter as a greater method of making the most of the tech explosion going ahead, quite than sticking with yesterday’s trailblazer.”

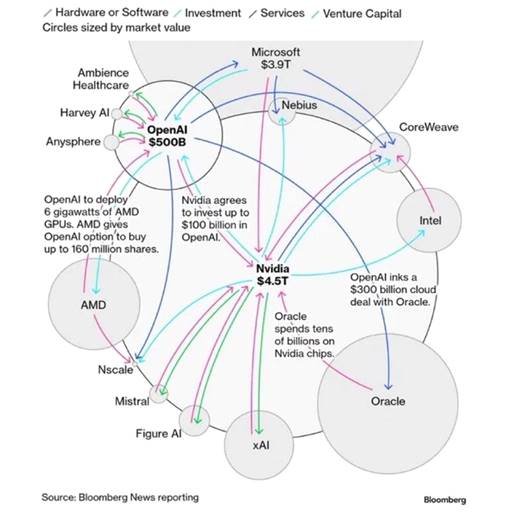

Truthfully, there’s no stopping these establishments. A lot in order that the US’s financial mannequin is now mainly these seven giants sending a trillion {dollars} forwards and backwards to one another.

Wired asserting that AI is the Bubble to Burst Them All, to Fortune declaring that “a collapse is certainly a risk.” There are many best-case eventualities that the tech leaders and buyers are drumming up for you. And a few are rosier than others.

However there’s little doubt once we say that every one of those firms are tied collectively in monetary offers which might be ticking time bombs. Even the Huge Brief- Michael Burry, who rightly predicted the housing bubble of 2008, positioned $1.1bn bets towards NVIDIA and Palantir.

Isn’t this a strategic transfer, or is all of it left to destiny’s arms?

AI might be persuasive. Nevertheless it’s all a big mess, not merely a bubble.

Source link

latest video

latest pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua