Ciente’s Picks Of Underrated Fintech Advertising and marketing Campaigns

Fintech looks like it’s all know-how. But it surely’s about creativeness that transcends this restricted notion. And listed here are fintech advertising and marketing campaigns that show it.

At its core, fintech advertising and marketing is like every other industry-specific advertising and marketing. The tech complexity and nitty-gritty in fintech oscillate. However the shell framework stays the identical.

What’s true for conventional monetary establishments is true for fintech- reliability, belief, and credibility. These are important necessities for even the earliest adopters. As a result of the to-and-fro of cash isn’t mundane.

This robotically makes fintech advertising and marketing not about advertising and marketing a fintech, however about assembly your clients the place they need you to. And transparency isn’t only a advertising and marketing development.

Conventional monetary establishments are going to catch up. Digital adoption is turning into crucial. Not a nice-to-have, however a must have. Transparency or every other components talked about above can’t be used as worth propositions by fintechs for the long run.

However fintech isn’t accomplished. The revolution hasn’t ended. And that’s the flicker.

Nevertheless, this isn’t being leveraged accurately. There’s a dissonance as a result of most clients belong to a non-financial background. They find yourself feeling disconnected from the model’s imaginative and prescient. And overexplaining solely makes them really feel unintelligent. It’s difficult to attach with the viewers as a result of, actually, nobody will get up within the morning to really feel obsessed with balancing their checkbooks. It’s tedious and never all that entertaining. However the demand’s there as a result of it’s crucial to our dwelling situations.

How do you make your viewers really feel enthusiastic about one thing so acutely banal?

You construct a very revolutionary fintech advertising and marketing marketing campaign.

It’s nothing new. There are manufacturers on the market which have mastered the artwork of fintech advertising and marketing campaigns.

And that’s exactly what we’re right here to speak about. Fintech advertising and marketing campaigns that broke by the custom with their daring moments. And made an impression on the {industry}.

Fintech Advertising and marketing Campaigns: Moments that Broke By means of the Humdrum Routine of the Fintech World

Catching and interesting the eye of your ICPs will not be a easy feat. Particularly when it’s one thing so monotonous. You should be tactical sufficient to not rub them the unsuitable method. Or create extra issues if you wished to resolve one.

What does that require? Positioning your self as a reputable and reliable fintech model. You may’t combine and match random advertising and marketing methods and anticipate them to work. Fintech calls for finesse and perception. It requires technique and creativity together with the statistics and options.

We’ve 5 fintech advertising and marketing campaigns to encourage you. And that can assist you break by the insipidness of selling such essential tech-centric options.

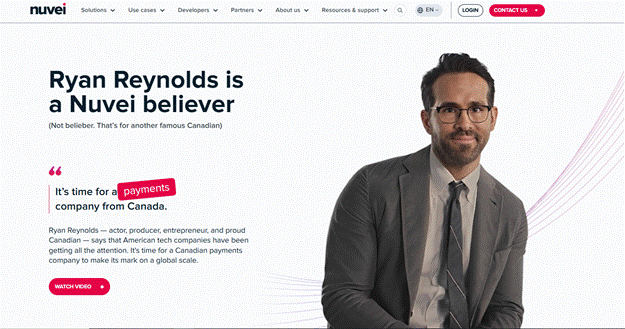

1. Nuvei x Ryan Reynolds

Nuvei is a funds powerhouse primarily based in Canada. It has an impenetrable viewers base of huge enterprise merchants- it’s very difficult to achieve these accounts. However with out a approach to attain its potential clients, Nuvei knew it could lose its market positioning.

The corporate needed to discover a method out of this conundrum. And the answer was fairly unorthodox.

Nuvei stepped into influencer advertising and marketing.

Sure, it appears bold for a fintech firm. However the level is that it really labored. Nuvei, a Canadian platform, would now have to decide on an influencer who can be its poster youngster and propagate its model story in the easiest way.

It selected a Hollywood A-lister: Ryan Reynolds. Identified for his humour and quirky demeanor. Really, it was Reynolds who invested in his homebound model. And as a part of the deal, he turned part of Nuvei’s ads.

Supply: Nuvei

These adverts turned the discuss of the fintech world. Due to its distinctive intersection of a B2B model comparable to Nuvei and Reynolds’ B2C storytelling technique. He had full management over the adverts and the content material, which allowed him to have his humor on full show.

The influence?

“Enormous. Particularly on model consciousness,” shares Alexandra Bucur, Nuvei’s Head of Content material Advertising and marketing.

They may attain publications that had been troublesome to get to until you paid. SDRs’ job turned a tad bit simpler as a result of now they may use Reynolds because the opener. They usually had tens of millions of views, that’s inconceivable with out paid advert channels.

It didn’t come right down to leads and gross sales for Nuvei. However the consciousness that it introduced? That had long-term results on Nuvei’s model positioning.

Possibly it’s not at all times concerning the numbers. However about creating memorable influence.

2. Your Manner In by Revolut

Revolut is as bold because it was years in the past. It aimed to develop into the main digital banking platform globally.

In 2022, Revolut teased a particular advertising and marketing marketing campaign to “attain” each UK client wherever they had been at residence, open air, and on-line. It sought to satisfy its potential clients wherever they had been. And that was fairly a method.

Supply: YouTube

Your Manner In was Revolut’s most important model consciousness omnichannel marketing campaign. And it made substantial splashes as a result of the model hadn’t printed campaigns at such a scale beforehand.

The advertising and marketing technique revolved round a novel message: monetary inclusion. It spoke on to the monetary underdogs, not specialists. For instance, one of many clips illustrated a lady buying and selling on her cellphone in a toilet. After which the wall breaks and collides with a room stuffed with merchants.

Revolut challenged monetary stereotypes with this marketing campaign. The rooms that had been beforehand too troublesome to crack? Cryptocurrencies? Buying and selling? Investing? Probably the most rewarding alternatives had been solely accessible to some segments.

Revolut wished to point out its viewers that it was potential to enter these “closed off worlds of cash.”

As atypical characters (or common folks) crash by these boundaries, the digital banking companies platform illustrates them bursting by partitions of monetary arenas and thru difficult monetary conditions by leveraging the Revolut app.

This marketing campaign labored as a result of the time was proper. As the price of dwelling surges, atypical folks need extra channels to realize confidence, monetary benefits, and monetary freedom.

Revolut understood the timing. And it delivered the marketing campaign, stuffed with relevance.

The influence? It resonated as a result of customers may enter a world they couldn’t earlier than.

3. Monzo: “Cash Has By no means Felt Higher”

The nervousness of cash administration plagues us all. And Monzo wished to be relatable.

Its “Cash Has By no means Felt Higher” marketing campaign was a humorous juxtaposition- printed throughout OOH and a 60″ hero movie. This marketing campaign was primarily based on two sides of the identical coin: the great and the dangerous.

In a consecutive collection of photographs, the video illustrates what managing cash usually looks like and the way it feels with Monzo. It’s artistic and constructed to spotlight Monzo’s worth proposition. The previous is chilly, tense, unsatisfying, and even painful. In the meantime, utilizing Monzo feels heat, peaceable, and zen.

Supply: YouTube

The imagery is commendable.

In a single a part of the movie, cash administration looks like the center of your workday, and you retain on banging your head on the keyboard. In the meantime, with Monzo, it looks like studying Kung Fu to interrupt by a wood board along with your head.

That’s hope. And the facility of studying. And that’s propagated by a bunch of juxtapositions. Nervousness with celebration. Screaming match with a loving second. Chilly with heat. Failure with success. The listing goes on and on.

The concept is easy. And it requires no additional clarification. The marketing campaign delivers Monzo’s message straightforwardly. It’s inserting Monzo underneath a vivid mild, but additionally showcasing that it cares about its customers’ emotions.

“Leveraging us will dispel the discomfort that you simply really feel in your day by day lives.”

The marketing campaign promotes Monzo’s options for patrons. Not about itself and what it may do for them. Monzo’s VP of Advertising and marketing places it fairly simply- “

Throughout the nation, cash evokes quite a lot of emotions, often stress, nervousness, and avoidance. Nevertheless, our clients inform us that on Monzo, cash feels totally different, a lot in order that they’re seven occasions extra seemingly to make use of the phrase ‘love’ when describing us than every other financial institution.”

The Gross Error Fintech Advertising and marketing Campaigns are Making

There are particular issues to be taught from these three fintech advertising and marketing campaigns.

The messaging includes an identical authoritative and informative tone throughout all channels. Even when the shoppers on the finish of the day are people. Those that really feel and partake in crucial considering.

However fintech corporations should grasp that not all consumers are CFOs. CFOs, Controllers, and Treasurers have monetary literacy. However they’re only one phase of the shopping for committee. Most of them are motivated by monetary enterprise and operational wants. IT Administrators, Operations workforce, and even finish customers don’t actually entail expansive monetary data.

Speaking in phrases that solely make sense to your personal model can drive your potential clients away.

Most shopping for selections are made with problem-solving in thoughts. It’s not about having the monetary or technical acumen. Even fintech corporations orchestrate options with non-financial customers in thoughts. It’s not about who the client is, however the finish customers who will leverage the options down the road.

That’s why fintech requires storytelling. Readability in what they provide and merely presenting the identical data isn’t sufficient. Your fintech campaigns depend on monetary jargon neatly filled with ribbons- “zero charges” or “immediate loans.” However these copies solely find yourself feeling spammy.

There’s no actual value- A tempting but naked minimal supply.

Do you actually assume consumers bear in mind these statistics? They don’t want extra causes to make a purchase order. They’re frightened of the funding that might flip futile. Your consumers aren’t merely assured of their choice. And that’s what it is advisable to assist them climate this dilemma.

They want causes they shouldn’t hesitate. Leaning into the unsure is frightening. How do they know if these options will reap rewards? They don’t. However they should transfer previous the hesitation. And really feel protected within the choice they’re making. It’s not a fintech drawback. It’s a market drawback.

Fintech Advertising and marketing Campaigns: What They Ought to Be

In a far-fetched state of affairs, your opponents have all of it found out. The highest to backside of fintech advertising and marketing. It’s all about presenting invaluable data for them.

The identical message circulates within the {industry} like a single meme. You snigger at it time and again till it loses its essence. That’s what occurs with advertising and marketing messages. Your fintech firm requires its personal distinctive storytelling to penetrate the complexity and oversimplification.

Past the monetary tidbits, you have to humanize your model. The brand-building entrance isn’t the maturity of your advertising and marketing operations that align with market buildings. It’s merely a single half. In fintech advertising and marketing, the emotional half is at all times a bit uncared for as a result of, actually, which enterprise chief wants emotional gibberish?

That’s incorrect.

For those who don’t instill storytelling throughout campaigns, you lose your clients. Product differentiation in fintech is at an all-time low. And also you want a very disruptive product to face out. There’s solely an incremental or marginal distinction in options, comparable to Stripe v/s PayPal. The place’s fintech’s true price? It will get misplaced in all the noise.

Your fintech advertising and marketing campaigns ought to revolve round empowerment- that’s what this digital transformation trickles right down to. Conventional monetary establishments have uncared for monetary inclusion for the longest time. Particularly within the area of asset and wealth administration. It’s time for fintech to vary that. And that ought to replicate of their messaging.

Advertising and marketing Campaigns as a Development Lever for Fintech.

For many buyers and newcomers, fintech stays a glowing diamond. When mixed with the promise of digital transformation, the spark turns into brighter. And that’s what fintech is making an attempt to grasp now- A stability.

Within the midst of chasing the tech fever, this up-and-coming {industry} has forgotten an important aspect- storytelling. Storytelling with feelings. Fintechs may be nice at underlining the how, however they aren’t that good at explaining the why.

Beneath all of the layers of safety, complicated options, and algorithms, the story will get misplaced.

Numbers are straightforward to clarify. However this has erased the human story. Fintech should deliver this again.

As a result of numbers might stale. However human experiences and their story doesn’t.

Source link

latest video

latest pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua